Article

Branch Transformation: A Primer for Modern Banks

Branch transformation strategy and the challenge of earning customer loyalty

“Branch transformation” focuses on increasing customer satisfaction and organizational performance by improving physical and digital experiences at bank branches. In today’s fast-paced, ever-evolving banking landscape, it has become a critical endeavor for banks and other customer-facing financial institutions seeking to:

- Stay competitive amongst their peers

- Sustain relevance with their current clients, and

- Draw the interest of prospective customers

Bank branch transformation—which institutions can scale to their needs based on size, geography, longevity, and other firmographic factors—helps banks maintain branch performance, manage operating expenses, reduce branch-related costs, maximize operational efficiencies, and increase revenue.

Bank branches have long been hubs for in-person transactions and customer interaction. While the architectural design of primary bank branches has remained essentially unchanged from the first national banks, the proliferation of disruptive fintech (financial technologies) now gives customers more options, such as whether to conduct their banking business remotely, no brick-and-mortar building required or look for another bank that more adequately addresses their modern needs.

As fintechs continue to disrupt the banking industry and offer customers a range of high-quality options, it’s no longer a choice but a necessity for banks to adapt.

Although a significant undertaking, branch innovation can be approached holistically and iteratively. A purpose-fit approach helps banks maintain their brand image, strengthen their relationships with the banking community, and exceed financial performance expectations.

The first part of this blog series will cover:

- How emerging fintech is disrupting the entire banking industry

- The unique challenges faced by small and regional banks

- An exploration of Frost Bank has responded to digitization by investing in physical facilities while still embracing emerging technology

- The first steps your bank can take to kick off the process, which we’ll discuss in greater detail in future posts

Considering the role of emerging technology

In the Finextra article “Bank Branch Transformation: Finding the Right Mix,” author Andrew Beatty makes three points that outline the challenge facing today’s banking branches.

#1: A shift from physical interaction to digital branch banking

“Digital-first banking has been a looming priority for years. And, for skeptics, the pandemic removed any doubt—banking has indeed become a digital business. One can say that digital banks are effectively technology companies operating within the constraints of a banking license. All over the world, disruptive forces are challenging traditional bank business models and redefining how banks interact with customers. Advanced technologies change what’s possible and may ultimately alter the concept of what it means to be a bank. This has serious implications for the future of bank branches.”

- In light of looming (and existing) change, how do banks and institutions across other financial sub-sectors engage in strategic innovation initiatives rather than surfing the wake of disruption and adopting inauthentic or ineffective strategies?

- Staring at an onslaught of disruptive fintechs—from artificial intelligence to machine learning and robotic process automation (RPA)—where should a bank even start its digital transformation journey? What’s the right play now, next, and in the future?

#2: The importance of avoiding the “ready, shoot, aim” impulse

“Although branch closures have dominated the headlines, many banks—including startups—are opening branches, while others are repurposing branches as advice centers. Banks that dispense with their branch networks do so at their peril. This may be a one-way street and there are salutary lessons from other industries that have committed solely to digital: Who could have foreseen the resurgence of vinyl records that are currently flying off the shelves?”

Ideally, strategic innovation is proactive rather than reactive, with organizations taking careful aim before making big decisions. Unfortunately, it doesn’t always play out this way, especially when facing the urgency to stay ahead of the back and avoid being rendered obsolete. But as we continue exploring the imperative for banking services innovation, consider this:

- From 2019 to 2023, “the total number of [US] bank branches declined by 5.6 percent, the number of banking deserts increased by 217, and the number of Americans living in banking deserts grew by 760,000.” (banking deserts are “a census tract or neighborhood which has no bank branches in it or within 10 miles of its center,” typically located in “sparsely populated areas” as opposed to urban centers)

- Statistics indicate a decrease in bank closures since 2023, with bankers communicating that “even their most tech-savvy customers want physical bank offices where they can seek financial advice.”

- Additionally, many institutions recognize that “accelerating digital adoption [needs] to be balanced with keeping a physical footprint for competition.”

Ready → aim → shoot.

Build a strategic game plan, align your team and your resources, and then initiate innovation, not the other way around.

#3: What works for your bank branch?

“While a branch network should offer a consistent experience, not all branches are equal. For example, flagship branches in key locations deliver high-impact brand value and recognition while community branches offer opportunities to deepen relationships. To add real value, the bank’s branch offers a perfect intersection of all banking channels.”

- What does ‘perfect’ look like for your institution or specific banking branch in terms of achieving “a perfect intersection of all banking channels?” What blend of new products and services authentically addresses your customers’ needs, decreasing pain points rather than adding unnecessary complexity to their banking journey?

- McKinsey states that “businesses are benefiting from using off-the-shelf solutions provided by digital natives for services such as payments, open banking, and core banking technology.” With off-the-shelf solutions available, do you need a custom fintech solution, or is a pre-existing product sufficient? Whether you go fully customized or off-the-shelf, how skilled are your people, and how robust is your technology infrastructure to support change?

- Regarding the proliferation of fintechs, McKinsey also cites that “new competitors have raised the bar on customer expectations. Both individual and organizational customers now seek a long list of attributes from their financial-service providers. Surveys show that these desires include high levels of personalization, zero friction, and a commitment to social and environmental impact.”

In sum, banks are dealing with a range of sky-high customer expectations. With so many options—from fintechs to traditional banking institutions—customers are in the driver’s seat.

But this isn’t a bad problem to have. Banks that evolve their branch design via incremental innovation stand to separate themselves from a crowded pack.

Approaching branch innovation on an individual basis

- A shift from physical to digital—

- Strategic discretion in light of transformation—

- Adopting solutions authentic to your bank—

The unifying theme of the previous points is this:

Banks must decide what transformation looks like for their institution and their brand.

To survive, banks of all sizes and geographies must consider new branch strategies to become more dynamic, technology-enabled entities with an innovative service model that seamlessly integrates digital and in-person experiences. However, branch transformation isn’t a one-size-fits-all proposition.

And to be clear, it is not just about adopting new technologies. Generative AI is creating seismic shifts in every industry. As Generative AI consulting services providers, we believe in establishing vision and strategy upfront. We clearly state on our Generative AI service page that building technical expertise and adapting your organizational culture to ensure ethics and transparency is vital to new technology adoption efforts.

Haphazard adoption of emerging tech can create problems, rather than solving them. Although modern banking environments are becoming increasingly innovative, customers still choose to do business with a bank based on traditional factors like trust and convenience. An authentic (and successful) evolution of your various service delivery models requires understanding not only the changing needs of new generations of bankers but also the preferences of your existing customers so that nothing’s lost in the transition.

This is a vital balance when adapting to the proliferation of emerging fintech solutions and achieving authentic, sustainable business value for your institution.

Challenges for small and regional banks

Whether your institution is located in a rural area, the outskirts of a banking desert, or an urban center, the traditional branch model is worth reviewing and adapting to meet the evolving demands of banking customers.

But for small and regional banks that lack the resources and people-power of their peers

- What level of adaptation and evolution for branch networks is feasible?

- How do banks meaningfully respond to bank branch trends when faced with technical and logistical constraints?

- When customers expect a seamless and personalized experience across all banking channels and brand touchpoints, how do you upgrade your branch’s capabilities to address the challenge at scale?

- If your institution has trouble generating the resources to address existing customer needs at a more basic level—irrespective of large-scale change—how can you keep pace with the light-speed rate of innovation that’s drawing your customers away?

In the words of McKinsey’s Pradip Patiath “When you’ve got banks like Chase and BofA spending over $7 billion a year on technology, how do you compete?”

Innovation isn’t inexpensive, but not innovating can lead to an even greater gap between small and regional baenks and their competition.

It’s vital to ensure that any transformation is authentic for your institution, customers, and brand. Texas’s Frost Bank, discussed in the next section, has harnessed this approach to great effect. And although Frost’s asset size is substantial, their hyper-geographical focus can serve as a blueprint for small and regional banks seeking to carve their own segment of the market.

“We want to be the bank for everyone in Texas”: How Frost Bank has adopted a physical-first approach (with human-centric digital integrations)

As small banks have declined and 27% of banking customers report having shifted to online-only banks, Frost Bank has expanded its physical brand footprint and hyper-localized approach in more ways than one.

In the Financial Brand’s article on how Frost Bank has approached its transformation, author Phil West highlights “[Frost Banks’s] customer service awards and its reputation for friendly banking, as well as its deep knowledge of a state with a business-friendly climate” and how “In 2023, Frost was the highest ranked retail bank in Texas in the J.D. Power 2023 U.S. Retail Banking Satisfaction Survey.”

The article also cites how Frost opened its 180th branch in the Dallas-Fort Worth Metropolitan area—specifically, in Grand Prairie, Texas—in 2023. That followed earlier expansions in the same area in 2022.

Deep knowledge of both its state and its customers’ banking needs has allowed Frost Bank to maintain its Texas-focused model while expanding innovative service offerings based on focuses such as mortgage lending (in response to the influx of people moving to Texas), with solutions such as Frost Progress Mortgage—a “product designed specifically for low- and moderate-income borrowers.”

While technology is often at the heart of transformation, Frost Bank’s Progress Mortgage service rollout is a prime example of how technology can enhance, not replace, human interaction. The bank has scaled back technology for a specific audience—“No automated calls, FAQs, or chatbots here.” This approach aligns with Frost Bank’s innovation philosophy: “Technology with a human side.”

Frost Bank has consciously prioritized expanding the one-on-one customer-centric approach to communication and relationships that has given the institution its longstanding reputation:

- Digitally, any innovative technology effort on behalf of the bank is guided by the compass of customer-centricity

- Physically, the bank consistently expands to more regions to serve more bankers, both inside and outside of urban centers

Strategic brand extensions to capitalize on a 50-year-old partnership with the San Antonio Spurs

In addition to adopting customer-friendly new products and new service introductions, diversification of transformation efforts has been central to Frost Bank’s strategy.

In 2023, the San Antonio Spurs Arena officially became the “Frost Bank Center.” The strategic move extends Frost Bank’s Texas-centered, physical-first approach to brand expansion and transforming their branch presence.

In the same article from the Financial Brand cited in the previous section, the authors quoted Bill Day, Senior Vice President, Corporate Communication Manager, on the sponsorship as another means of physical presence:

“We’re only in Texas, but keep in mind that Texas has three NBA teams [ . . . ] We’re going to get a lot of exposure in those markets as well when those teams play in San Antonio. We have big expansion projects underway in the Houston area and in the Dallas area. It will triple the number of locations that we have there.”

Fresh’s internal innovation lab—Fresh Labs, the creators of the award-winning generative AI tool, Brancher.ai—has played a role in the digital transformation of the Frost Bank Center, contributing to its arena wayfinding tool. The project extended Fresh Labs’s work with Charlie Kurian and Spurs Sports & Entertainment to bring immersive technology to Spurs Week in Austin.

While it might not be appropriate for every bank, Frost Bank’s strategy involves physical expansion, building a brand footprint, and not reinventing the wheel with customer experience but strengthening its relationships and state-wide reputation.

Regarding the naming rights for the Frost Bank Center, the Financial Brand states that the Frost Bank is paying $9 million a year. Despite its geographical focus in Texas, Frost Bank is still “the 41st-largest in the country by asset size, with $50.9 billion in assets.”

These are significant financial figures that are well out of reach for many small and regional banks. The point of the sections above is not to assume that all small and regional banks can support investments of that scale but rather to highlight that for Frost Bank, their transformation is authentic to their institution, taking into account:

- How to approach the industry-wide shift from physical to digital

- How to maintain strategic discretion in light of transformation

- How to adopt solutions authentic to your bank and continue serving customers

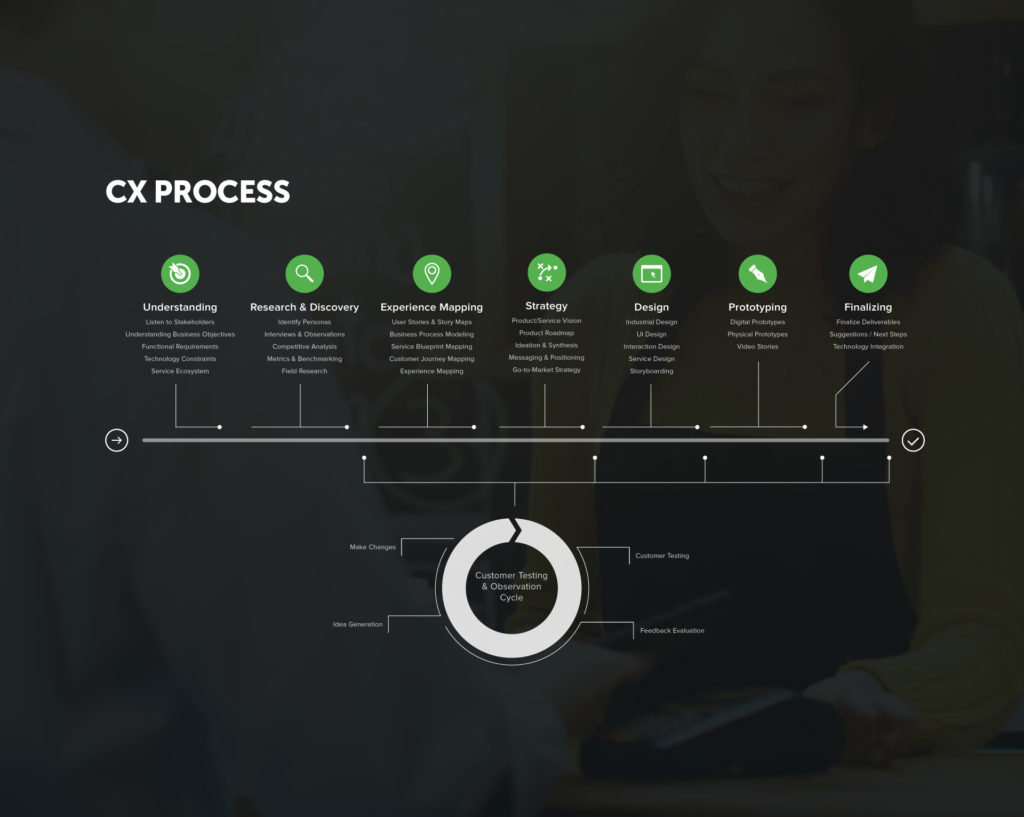

Three steps to implementing effective branch transformation solutions

In subsequent posts, we’ll explore topics such as the “smart branch” and strategic focuses for banks of all sizes to incrementally transform their services in light of changing customer preferences.

For now, we’ll end with concrete considerations for banks considering starting their journey. Remember, however, that the items listed below are not prescriptive. If you were to work with Fresh, we might decide that certain items aren’t needed or that a different cadence would be more beneficial after speaking with your team.

The point is this: your organization can begin its journey by considering the questions above and those that follow. Any pre-work you do is worthwhile and can accelerate your path to value.

The Challenge Document: Identify your bank’s core challenges and brainstorm branch strategies

Whatever you call it—and whatever level of formality it initially takes—a challenge document focuses on identifying and defining the specific challenges an institution faces related to branch innovation or any other critical project.

The purpose of a challenge document is to clearly articulate the nature of the challenge and the rationale for addressing it. Even before you work with a consultancy, your team can generate an agreed-upon high-level summary identifying and defining the specific challenges you’re facing as you adapt to the intricate landscape of modern banking and your bank’s transition to a new way of serving its customers.

If you don’t have every question or concern addressed, that’s not the point. Any foundational work and ideas are beneficial and can accelerate work done with a third party.

Elements often included in a challenge document are:

- The problem statement—a clear and concise description of the challenge and how it affects your bank

- Goals and objectives—the desired outcomes and objectives that addressing the challenge will achieve, such as transforming branches into experience centers, generating ideal customer behavior, and optimizing staffing

- Market analysis—an examination of financial market trends, banking customer needs, and your bank’s competitive landscape.

- Current state analysis—an assessment of the current situation related to the challenge, including your institution’s strengths, weaknesses, opportunities, and threats (SWOT analysis); the current state analysis also includes bank-related geographical data, customer demographics, and other essential details

- Initial proposed solution—a high-level approach or strategy for addressing the challenge, listing the why and the what, as well as expected benefits, costs, and other key considerations

- Stakeholder analysis and engagement—expected or desired involvement of key bank institution stakeholders throughout the process

The Needs Assessment: Analyze gaps and address requirements for branch modernization

Needs assessments identify your organization’s gaps, opportunities, and requirements to realize your strategic vision. Your needs assessment should build on the foundation of a challenge document, allowing your organization to look in the mirror and honestly answer how well-equipped you are to follow through on innovative initiatives in light of the rapidly changing banking landscape.

This work will be done in even greater detail with a third party. Still, foundational work is useful as your stakeholders and employees know the challenges your institution is facing.

Items in a needs assessment often include:

- Expanded background and context—an overview of your institution’s needs, customer satisfaction, and customer needs, how the industry and your competitors are serving them, and the overall market environment

- Technology and resource assessment—an expansion of the initial technology requirements analysis, assessing the specific fintech tools and resources needed to successfully incorporate new digital technologies and bridge the gap with legacy technology systems

- Deeper financial analysis—continued cost-benefit analysis and financial feasibility assessment as your plan takes shape

- Expanded risk assessment—additional identification of risks and proposed mitigation strategies from impacts to technology infrastructure to the physical alteration of branch buildings

- Change management and training needs—assessment of the organizational impact of branch innovation initiatives and the training requirements for bankers and other personnel, ensuring your program’s success

- Resource requirements—resources needed for branch transformation, including budget, staffing, and new technology or modifications to legacy technology infrastructure

The Roadmap: A strategic plan for optimizing your bank branch

This vital deliverable outlines a structured approach to achieving long-term objectives and realizing desired outcomes within your branch transformation program. From optimizing staffing to reimagining customer transactions, from reducing the scope of cost-to-serve items to ideas for conserving cost-to-serve resources, a strategic roadmap paves the way for bringing branch innovation solutions to fruition and situating your institution for sustainable growth and success.

Components of a strategic roadmap sometimes include:

- Vision and goals—a clear articulation of your vision and goals, accounting for changes from initial work

- Future state vision—a clear definition of your bank now, what’s next, and what’s possible in the future

- Specific strategic initiatives—refine and highlight individual projects that will help your institution achieve its goals

- Timeline and milestones—these can and will change; however, you should have an agreed-upon schedule to ensure an outcomes-driven approach with timelines and milestones for each branch innovation initiative

- Governance structure—reiterating key roles, responsibilities, and governance structure for overseeing your institution’s program

- Monitoring and evaluation—list the metrics, KPIs, and mechanisms to track progress and evaluate the success of your program

Customer-centricity is a key to success

Every year, new technologies take the world by storm. Industries are upended as world events transpire. Unforeseen obstacles enter our organizational vision, requiring a more immediate course correction.

If organizations set their eyes on a fixed destination, what happens when the landscape experiences a seismic shift? If an organization doesn’t have any kind of destination in mind, where exactly is the journey intended to lead?

Although it is certainly an involved undertaking, branch banking innovation can be approached in iterative fashion. Whether through rapid prototyping or innovation-as-a-service, we recommend this approach. It allows organizations of various sizes to decide on a destination and drive toward outcomes while pivoting and adapting as needed, which in our rapidly transforming world is an inevitability.

Concerning the banking industry, while new technologies will emerge and necessitate a change in plans or events out of your control can impact your trajectory, the common theme with Frost Bank or any other bank seeing success with innovative initiatives is simple:

- They listen to their customers

- They focus on addressing their customers’ needs

- They do so in a way that’s authentic to their institution’s existing brand and reputation

Remaining customer-centric and being adaptive in responding to their needs will ensure that your branch transformation journey—however involved—is successful.