Sector

Fintech is transforming the financial industry with tools that empower consumers, personalize experiences, and help traditional financial institutions meet today's customer demands. Fresh helps fintech companies to develop new products, enhance operational efficiency, improve risk management, and build customer loyalty.

Preparing for the future of finance

In light of today’s user needs and an increasingly connected world, exploring fintech is vital for financial organizations. For those willing to invest in transformation, the potential to revolutionize how customers and partners manage, access, and utilize finances and financial services drives significant value.

By evaluating digital transformation, innovation, and product development opportunities through the fintech lens, you can enhance your offerings, drive organizational growth, increase market share, and better serve evolving customer needs.

Meet customers on their financial journey

Today’s financial customers expect a seamless fintech experience. The Fresh team can help you deliver with:

Customer personalization: Deliver personalized financial products, build digital platforms, and expand your reach.

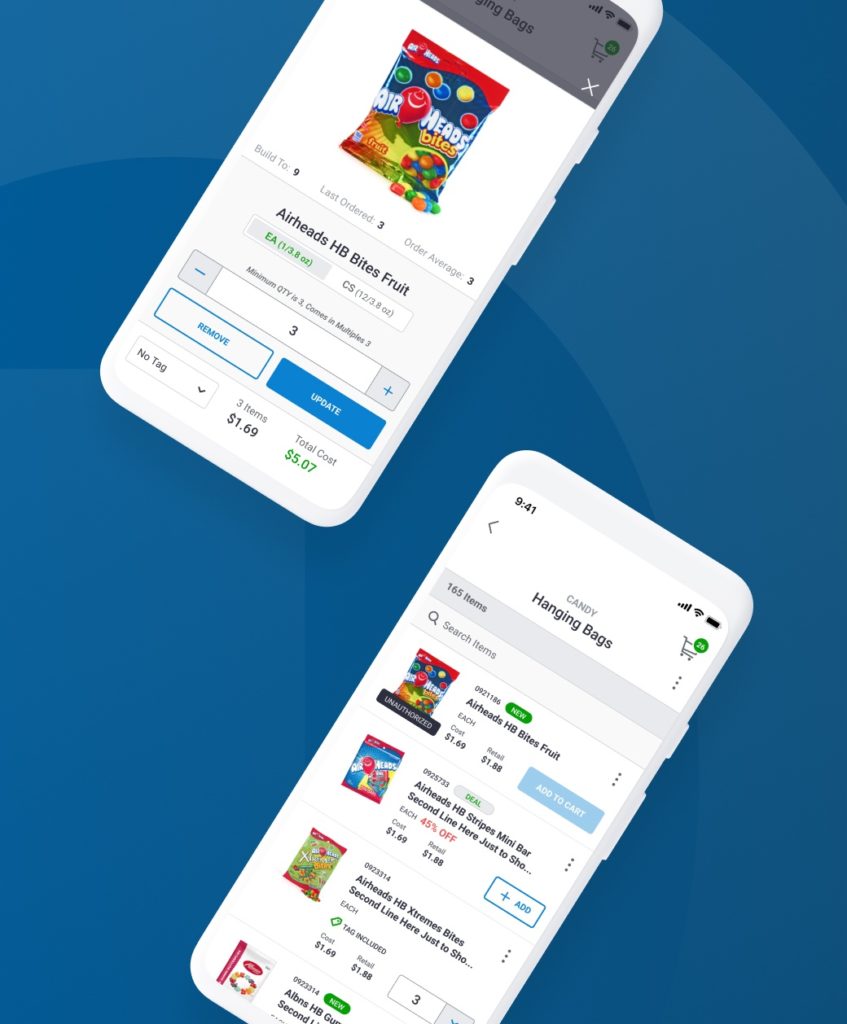

Customer empowerment: Create apps for real-time processing, alternative lending and digital banking options, financial accessibility, and more.

Customer Trust: Automate processes, lower fees based on better efficiency, and incorporate blockchain, biometrics, and encryption for best-in-class security.

Embrace transformation to realize ROI

With over 15 years of experience consulting for financial organizations, we help our clients leverage fintech to prepare for the future. If your organization already has fintech solutions in place, we can provide the team you need to continue improving and expanding solutions to meet the evolving needs of your customer base.